Brexit Bulletin: Britain Votes (Again)

https://www.fastbaze.com/2017/06/brexit-bulletin-britain-votes-again.html

-

Voters in the U.K. head to polls two weeks before Brexit talks

-

PM May called snap election but has faced a tricky campaign

In the fourth major ballot in as many years, Britons will on Thursday choose the government tasked with delivering Brexit.

The final opinion polls suggest that Prime Minister Theresa May’s Conservative Party is on course for a decent win, boosting its previous 17 seat majority in the House of Commons. That would theoretically give her more political space to negotiate Britain’s departure from the European Union when talks begin in two weeks.

Theresa May made several campaign stops across England on Wednesday.

Photographer: Chris Ratcliffe/Bloomberg

On Wednesday May made her final pitch to “strengthen my hand as I fight for Britain.”

Still, seven weeks on the campaign trail revealed flaws including brittleness and a willingness to reverse course under pressure. Critics will say whatever the margin of victory, it could have been bigger and that EU leaders will have noted her weaknesses.

And if Labour Party leader Jeremy Corbyn pulls off a shock victory or does enough to leave no party in control of Parliament then Brexit would probably soften, although not before another dose of uncertainty roiled markets.

Labour leader Jeremy Corbyn has been speaking to sizeable crowds in the closing stages of the campaign.

Photographer: Simon Dawson/Bloomberg

- Five election night scenarios and what they mean for Brexit

- What the parties are promising

- An hour by hour guide to what happens after polls close at 10 p.m. in London

- Meet the eight nerds who create the authoritative exit poll in a sealed room

- Follow the results on the Bloomberg Terminal, Bloomberg.com, Bloomberg Television and @bpolitics

Is May a Loser Whatever Happens?

May called the snap election to fortify her position, but instead it threatens to leave her weaker.Conservative ministers and candidates are privately furious at the way the party mismanaged the campaign after a poll lead over Labour collapsed from more than 20 percentage points, reports Bloomberg’s Tim Ross.

The upshot is that even if she is returned as premier, May will face immediate demands from her own side to change the way she runs the government, having previously relied on the advice of a handful of key aides. Her errors also mean she will have to quickly demonstrate she has more to offer than Brexit and will leave her own lawmakers quicker to judge her if she struggles in the talks.

“Even if she wins a comfortable, if not overwhelming, majority, it’s difficult to see May leading the Tories into the next election,” said Tim Bale, professor of politics at Queen Mary University of London.

The State of Britain

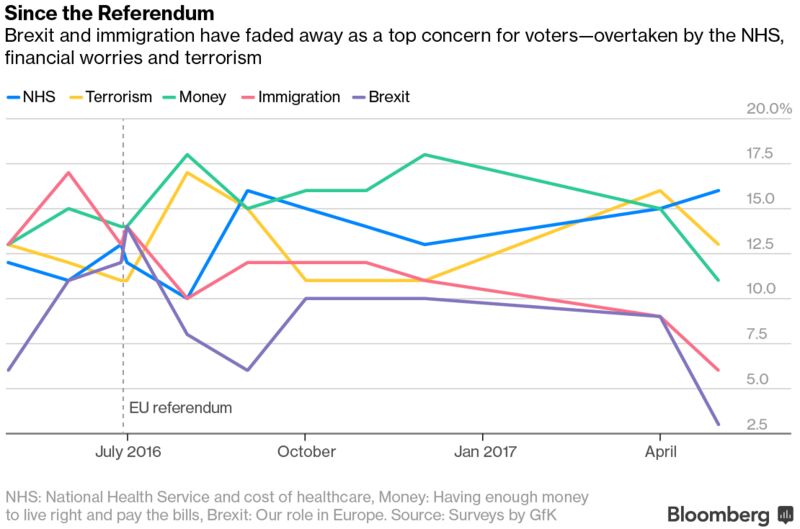

It was meant to be the Brexit election, uniting a nation behind May as she enters divorce talks with the EU.Instead, as Bloomberg’s Marc Champion reports, it exposed a disunited kingdom amid divisions among English and Scottish nationalists, young and old, migrants and natives, London and the rest.

Whatever the result on Thursday, the public will stay deeply unsure of its political and economic future at the same time as it endures a terrorist campaign not seen for decades. At the heart of the disquiet is still the fallout from the financial crisis, including the fiscal austerity and anti-establishment sentiment it generated.

“And yet it is busy pretending that challenge does not exist.”

On the Markets

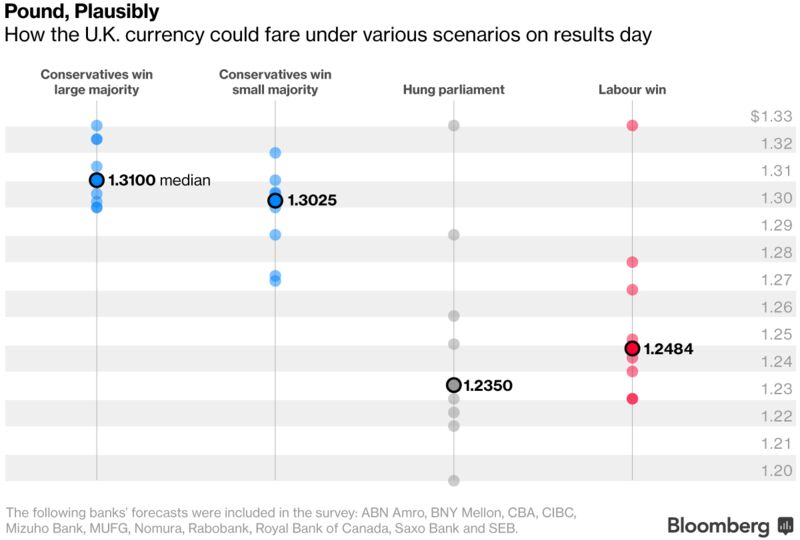

A poor election for May might be good for the pound further down the line.While sterling would likely fall in the political uncertainty swirling around a hung Parliament or a small Tory majority, such a result could increase the prospect of a so-called “soft Brexit” – one with continued access to Europe’s single market.

That could give traders a reason to be bullish once the election dust settles, according to strategists from Morgan Stanley, Nomura International and Bank of America Merrill Lynch.

As for bonds, Andrew Benito of Goldman Sachs reckons the difference in the yields of U.S. Treasuries and U.K. gilts might widen further amid concern over the Brexit talks.

“That divergence in yields is a good indicator that markets are quite pessimistic about the medium-term effects of Brexit on the U.K.,” he said.

Brexit in Brief

- With leaders like this Britain should panic, says Bloomberg View’s Clive Crook

- German Chancellor Angela Merkel says she expects Brexit negotiations to start swiftly after the election

- EU to outline next set of plans for developing the bloc’s capital markets

- OECD warns economy to slow next year as Brexit nears

- U.K. Information Commissioner Elizabeth Denham warns terror fight means U.K. needs EU-wide data after Brexit

- French senators say three bankers could be hired in Frankfurt for the cost of two in Paris

And Finally…

Chris Coghlan loves a challenge. He joined a hedge fund just as the global financial crisis was getting into full swing. Then he took a job with the U.K. Foreign Office’s counter-terrorism unit. Now he wants to reverse Brexit.The 36-year-old is campaigning as an independent in the southwest London neighborhood of Battersea, where about three-quarters of voters opposed leaving the EU in last year’s referendum. His opponents include Liberal Democrat Richard Davis, a former hedge fund analyst who now runs a team of data scientists at Lloyds Banking Group.

“I don’t accept that because 52 percent voted to leave, that’s a fixed outcome,” Coghlan told Bloomberg’s Tom Beardsworth, referring to the national margin. “You can only complain for so long before doing something about it.”

Chris Coghlan, independent candidate standing in Battersea.

Photographer: Luke MacGregor/Bloomberg

Post a Comment